tax return unemployment covid

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. If you received unemployment income during a given year you must report it on your annual tax return.

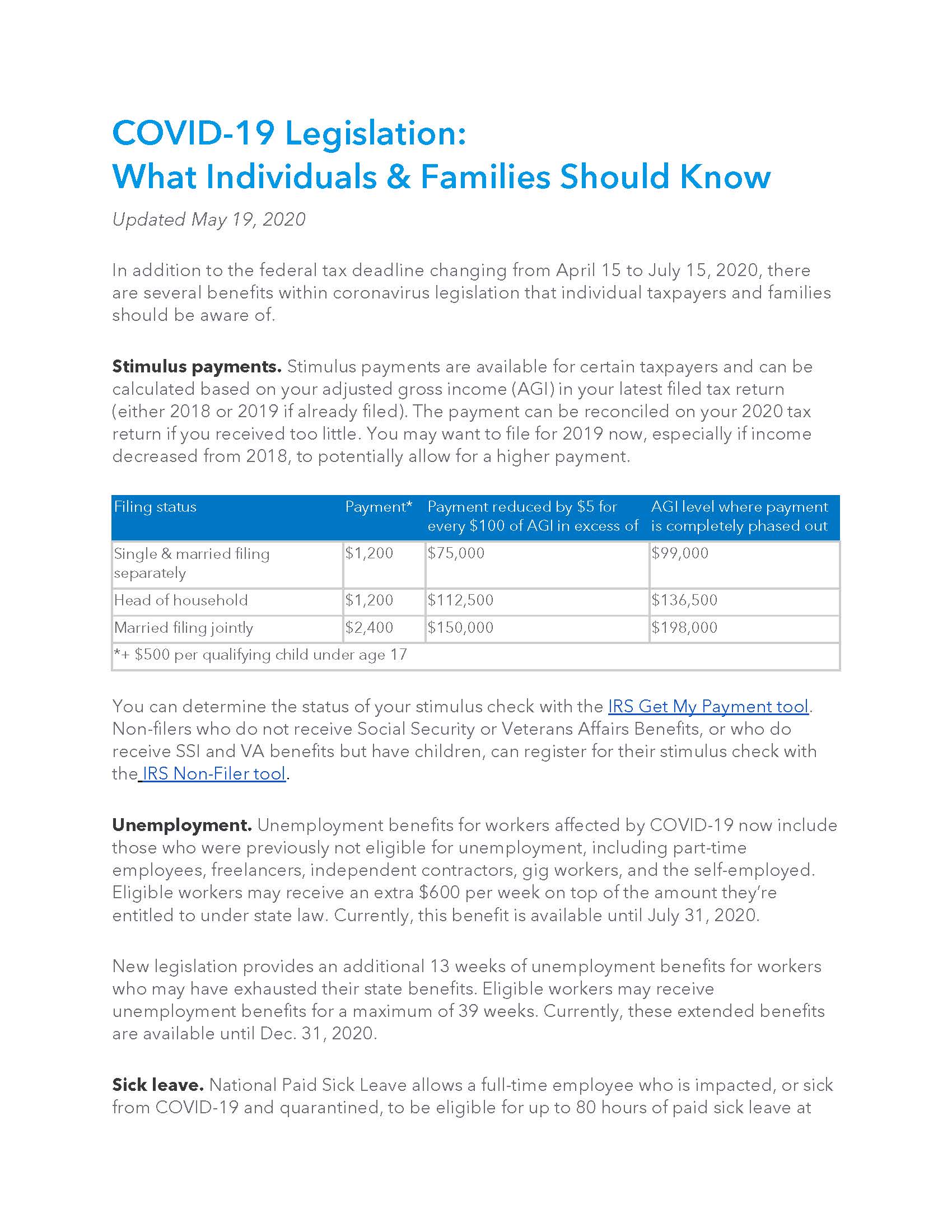

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits The Motley Fool

Any unemployment compensation in excess of 10200 10200 per spouse if married filing jointly is taxable income that must be included on your 2020 tax return.

. It gives a federal tax break on up to 10200 of unemployment benefits. COVID-19 extended unemployment benefits from the federal government have ended. This applies to 2020 only.

In order to do this. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. President Joe Biden signed the American Rescue Plan a 19 trillion Covid relief bill a month into tax season.

The new relief bill will make the first 10200 of benefits tax-free if your income is less than 150000. The 19 trillion Covid relief bill gives a federal tax break on up to 10200 of unemployment benefits. COVID Tax Tip 2021-46 April 8 2021 However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

Both the Qualified Sick Leave and Qualified Family Leave tax credits have been made effective as of April 1 2020 and end March 31 2021 under the COVID-related Tax Relief Act of 2020. The latest 19 trillion stimulus package created a new tax break for tens of millions of workers who received unemployment benefits last year after businesses were forced to. The American Rescue Plan makes the first 10200 of unemployment income tax-free for households with income less than 150000 for.

Unemployment benefits tax break. Coronavirus Unemployment Benefits and Tax Relief. But you may still qualify for unemployment benefits from.

The IRS told Americans to wait to file an amended tax return if they. Taxpayers should not have been. You can opt to have a flat 10 of your benefits withheld to cover the tax liability.

PUP was available to employees and the self-employed who lost their job on or after 13 March 2020 due to the COVID-19 pandemic. The IRS considers unemployment payments to be taxable income. For married couples filing jointly who both had unemployment insurance the tax-free amount is 20400 but combined adjusted gross income must still be less than 150000.

You may be required to file a tax return when youre unemployed depending on your situation and doing so can have benefits. The catch is that withholding the appropriate amount of income tax is voluntary. If youve already filed your taxes watch for Internal.

If youre eligible for any refundable tax credits the. COVID-19 Unemployment Benefits. The PUP payment is now closed.

The American Rescue Plan added some temporary relief people can claim in the form of 2021 tax refunds yet those who collected unemployment and stimulus checks might be. The newest COVID-19 relief bill the American Rescue Plan Act of 2021 waives federal taxes on up to 10200 of unemployment benefits an. The legislation signed on March 11 allows taxpayers who earned less than 150000 in modified adjusted gross income to exclude unemployment compensation up to 20400 if.

Get Ready To Owe Lots In Taxes Over Covid 19 Unemployment Benefits Iheart

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

3 Most Common Questions Taxes Stimulus And Unemployment Wfmynews2 Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Rescue Plan Exempts 10 200 In Unemployment Benefits From Taxation

The Irs Begins 2020 Income Tax Season While Dealing With Lingering Covid 19 Delays Wdet 101 9 Fm

Stimulus Check Update When Will Plus Up Covid Payments Arrive

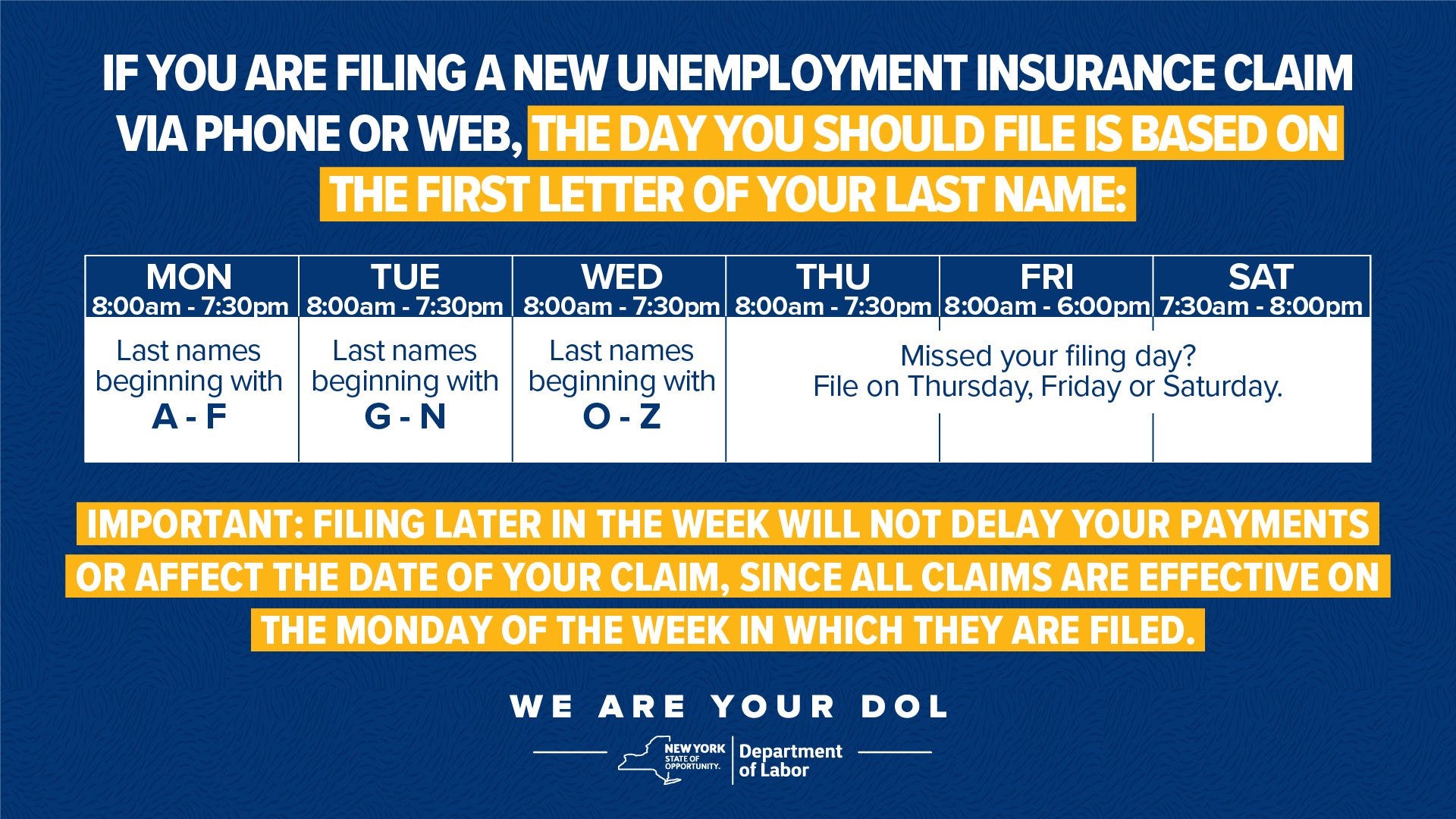

Unemployment Insurance During Covid 19 Councilmember Elissa Silverman

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

State Conformity To Cares Act American Rescue Plan Tax Foundation

Covid 19 Tax Resource Center Tax Updates Intuit Accountants

Irs To Send 4 Million Additional Tax Refunds For Unemployment